Are you keen to learn about what a money market account is? MM accounts are bank accounts but their interest rates are usually higher than any other customary savings accounts. These accounts are generally hinder your withdrawals mostly every month and have a higher minimum balance requirement than conventional savings accounts. MMM funds are different from money market accounts and these funds are investments in temporary debt protection.

When you worry about where to maintain your well-earned cash, checking and savings accounts may come to your mind sooner. MMA provides safety, and growth for your savings as you frame your financial ideals. The information below can help you determine if a money market account is suitable for you.

In this guide, you gather knowledge about what a money market account including its origin understanding, usage method, features, benefits, drawbacks, and alternatives.

Origin Of the Money Market Accounts

When was this account first created? Money market accounts were first established in the 1970s and started growing in the 1980s, mainly from the 1980 Depository Institutions Deregulation and Monetary Control Act, which eradicated cap limitations on bank savings rates.

Understanding Of What a Money Market Account

Have you ever created an MMA account? An MMA is an economic investment deposit machine that integrates the aspects of a bank savings account with checking account-like details.

It presented especially by banks and credit federations, money market accounts always come with high-interest-rate returns compared with bank savings accounts. Occasionally two or even three percentage points increased than regular bank savings account rates.

How Do You Use a Money Market Account?

Is it worth using to save your money? Yes, yes, this is a valuable tool to rejuvenate your preliminary budget and initiate working towards your immediate savings purposes.

- MM accounts have the accessibility of an ATM, you can easily withdraw your cash from anywhere. Regardless, these accounts may specify typical monthly dealings, such as online transfers and outgoing checks.

- Financial organizations repeatedly propose a spaced-out interest rate on MMA than on checking and savings accounts.

Features Of a Money Market Account

Higher Safety

Money market accounts are greatly safer than financing because even secure investments can result in your financial deficit.

Grandly Interest Rates

One of the primary advantages of unlocking a money market account is that they grow to deliver grandly higher interest rates than old savings accounts. When you might see identical rates presented by the profitable online banks. In trade, they generally need you to set more capital into them than a savings account would.

Availability of Funds

MM accounts are greatly more runny than investments or CDs. They can also deliver just easier availability to your funds than savings accounts, although not every money market account does. Money market accounts typically go with ATM cards, debit cards, paper checks, or other paths to access your cash that savings accounts don’t normally offer.

Risk Control

Money market accounts are risk-free because they are bank funds. With money market accounts, you can have straightforward access to your finances during trouble while still earning an incredible rate, and you don’t need to worry that your money will be taken off when you require it most.

Alternatives to a Money Market Account

| Characteristics | Money Market Account | CD | Checking Account | Money Market Fund | Savings Account |

| Interest Type | Variable | Absolute | Variable | Variable | Variable |

| Checks Allowed Or Not? | Limited | No | Yes | Limited | No |

| Average APY | 0.64 °/° | 0.23-1.32 | 0.07 | 3.6-4.6 | 0.41 |

| Federally Assured? | Yes | Yes | Yes | No | Yes |

| Average Minimum Opening Deposit | 2,500 Dollars | 0-1000 Dollars | 25-100 Dollars | 0-3000+ Dollars | 25-100 Dollars |

Benefits Of a Money Market Account

Are you wondering what a money market account is and what its advantages are? You will consider that saving with a money market account is wonderful. Here is the list of its advantages:

Right Of Check-Writing

You are capable of writing a restricted number of checks from your money market account, which stops the need to move funds from savings to checking.

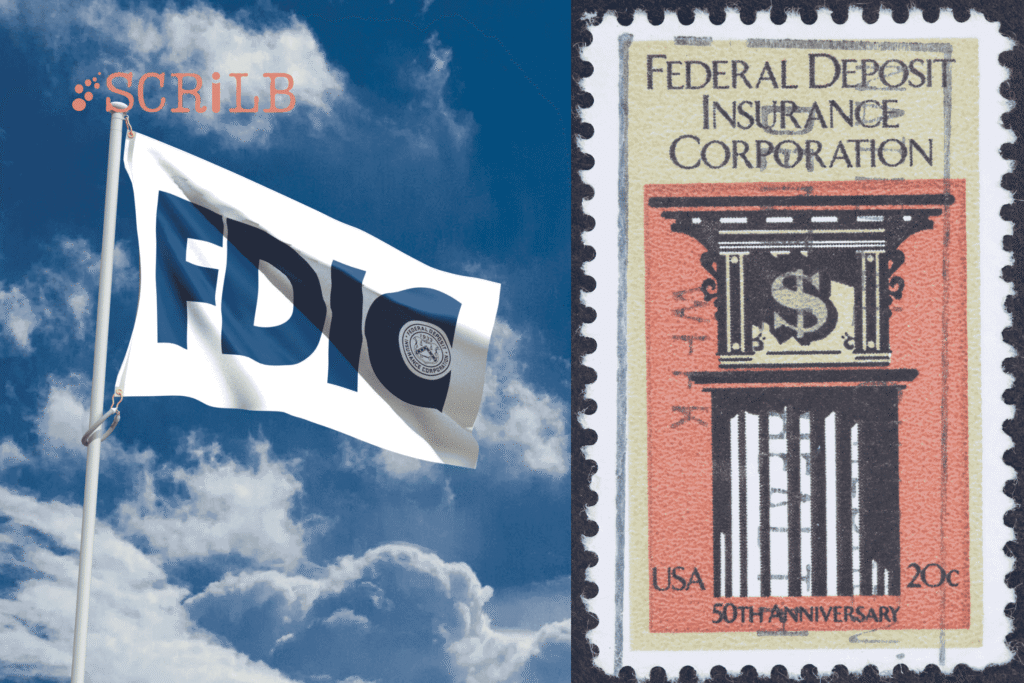

Insurance Of FDIC

The Federal Deposit Insurance Corporation (FDIC) guarantees money market accounts held at FDIC-secure banks. Deposits are assured up to 250,000 dollars per depositor, per FDIC-secure bank each ownership group.

Drawbacks Of Money Market Account

Initial Deposit

MMA may be restricted relatively by minimum deposit needs.

Top Management & Service Charges

Apart from generating charges from check writing, banks and credit unions also pay high operational fees for MMAs relative to savings and checking accounts.

Withdrawal Restrictions

Money market accounts sometimes have withdrawal limitations. Generally, those restrictions were no more than six withdrawals every month, by the federal Regulation D limits. The cap limitations were lifted as a federal rule, facilitating individual banks to place their withdrawal restrictions. Account users may be obligated to pay a fine for excessive withdrawals.

Conclusion

In conclusion, the answer to what a money market account is very precise. It is a class of savings account proposed by banks and credit unions that usually incorporates characteristics such as check-writing and debit cards. The accounts generally restrict the digits of these investments and transfers to six every month.

ATM withdrawals are normally not limited. Regardless, individuals who desire to keep for long-term purposes such as retirement would do much promising with higher-paying financing accounts planned for those goals, like IRAs and 401(k)s. Finally, you read about what is a money market account in this guide. Did you find this information helpful to you?

FAQs On What Is A Money Market Account

1: Are money market accounts taxable?

Yes, the interest income from MMA is taxable. Your bank or credit union will send you a yearly statement showing how much you earned.

3: What are the typical limitations of a money market account?

MMA often has a higher minimum balance demand than old savings accounts. Users have to pay higher fees, and there could be limits on how frequently they can take out money from the account.

For more information, visit Scrilb.com